Download The Wall Street Crash Worksheets

Do you want to save dozens of hours in time? Get your evenings and weekends back? Be able to teach The Wall Street Crash to your students?

Our worksheet bundle includes a fact file and printable worksheets and student activities. Perfect for both the classroom and homeschooling!

Table of Contents

Add a header to begin generating the table of contents

Summary

- Black Thursday and the context before the 1929 Crash

- The situation in the New York Stock Exchange (NYSE) before the crash

- The 1929 Wall Street Crash

- Media lighting on the event

Key Facts And Information

Overview

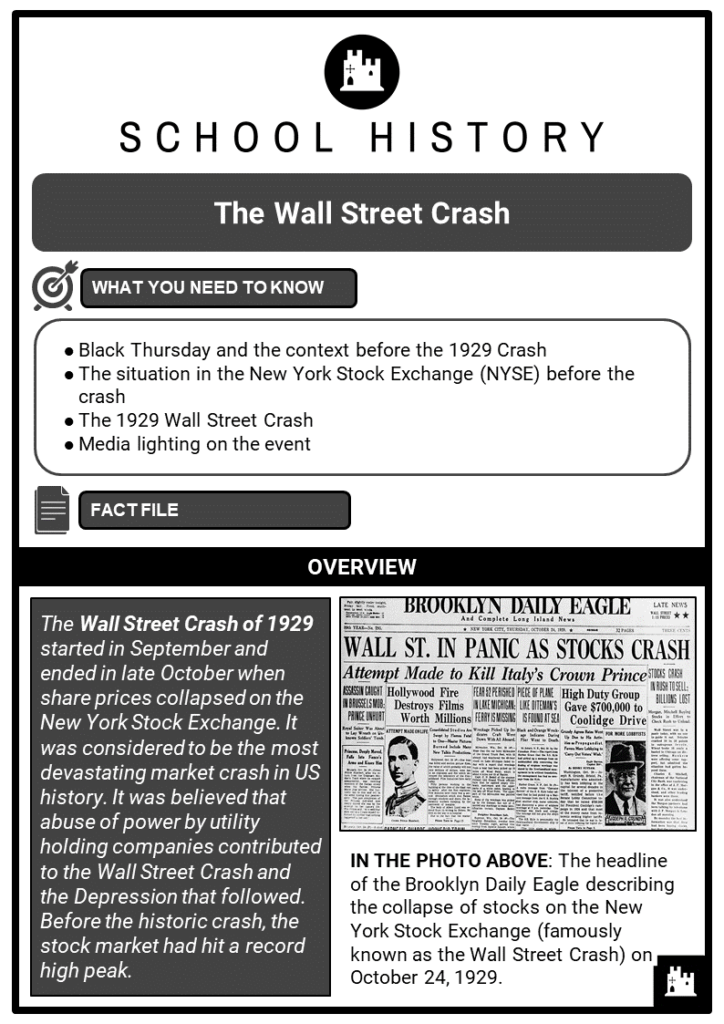

- The Wall Street Crash of 1929 started in September and ended in late October when share prices collapsed on the New York Stock Exchange. It was considered to be the most devastating market crash in US history. It was believed that abuse of power by utility holding companies contributed to the Wall Street Crash and the Depression that followed. Before the historic crash, the stock market had hit a record high peak.

Black Thursday And The Context Of The 1929 Crash

- Black Thursday (Oct. 24, 1929)

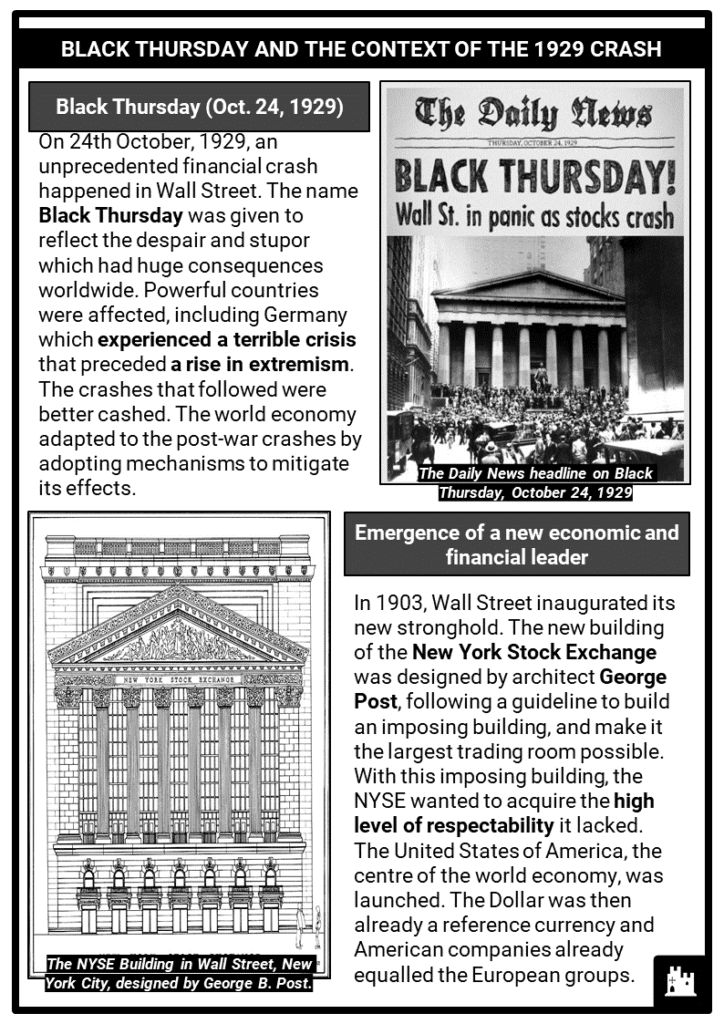

- On 24th October, 1929, an unprecedented financial crash happened in Wall Street. The name Black Thursday was given to reflect the despair and stupor which had huge consequences worldwide. Powerful countries were affected, including Germany which experienced a terrible crisis that preceded a rise in extremism. The crashes that followed were better cashed. The world economy adapted to the post-war crashes by adopting mechanisms to mitigate its effects.

- Emergence of a new economic and financial leader

- In 1903, Wall Street inaugurated its new stronghold. The new building of the New York Stock Exchange was designed by architect George Post, following a guideline to build an imposing building, and make it the largest trading room possible. With this imposing building, the NYSE wanted to acquire the high level of respectability it lacked. The United States of America, the centre of the world economy, was launched. The Dollar was then already a reference currency and American companies already equalled the European groups.

- The benefit of the 1914-18 war for the United States economy

- The world conflict of 1914 was an advantage to the US economy. During the war, European countries bought US exports and by 1918, a financial gap had formed between the US (where the standard of living had increased) and European countries which had seen standards decrease as a result of owing a huge debt to the US. At the economic and stock market level, Wall Street had surpassed its competitors in Europe. Indeed, European countries lost a big part of their market share on the South American continent during the first World War because they had to focus on the war effort. The US took advantage of this to consolidate their positions in this market.

- Increasing economic growth in the United States

- Until 1929, the economy grew with excellent results. In 1929, America was at its peak and there was a blind faith in its financial security. It was even imagined that poverty would soon be eradicated. In this climate of confidence and growth, the financial markets started to seduce more and more people. All social categories became potential investors. The years before 1929 had seen record leaps: + 27% and + 31%. New financial mechanisms emerged. Securities could be bought with just a partial payment, and the transaction would be balanced at the point of resale. Such a mechanism is favourable to the economy during periods of growth, but it is extremely dangerous at other times. The crisis surprised the world.

The Situation In The Nyse Before The Crash

- There was reckless speculation on the New York Stock Exchange. Everyone invested stocks, which resulted in a rapid expansion of the stock market. It reached its peak in August 1929.

- In August 1929...

- Decline in production, wages were low

- Rise in unemployment and consumer debt

- The US economy entered into a mild recession as consumer spending slowed down

- The agricultural sector of the economy struggled due to drought and falling food prices

- Banks had an excess of large loans that could not be liquidated

- Stock prices continued to rise, and by the autumn of 1929, they reached high levels that could not be justified by expected future earnings.

The 1929 Wall Street Crash

- OCTOBER 24, 1929 “Black Thursday”

- Investors panicked and began selling many overpriced shares. A record of almost 13 million shares were traded on that day.

- OCTOBER 29, 1929 “Black Tuesday”

- Another wave of panic hit Wall Street as 16.5 million shares were traded. These ended up worthless.

- In the wake of the stock market crash on Wall Street, there was a dramatic decrease in spending and investments.

- Industries began to decrease production and lay off workers or filed for bankruptcy. Unemployment rose to 16% in 1931.

- The Wall Street Crash lasted for 22 days, constituting the longest stock market crisis in history. From September to November 1929, the price of securities fell from index 381 to index 198. It is often suggested that this stock market crash was the trigger for the great economic crisis of the 1930s, which not only affected the US economy but all the capitalist economies in the world. However, it seems that this crash was more of an indication of a slowdown in growth at the end of 1928 and the stock market crisis was in fact only a link in the chain that went on to disintegrate western economies. For several months, anticipated financial reward no longer corresponded to the real state of the economy, which was slowing down. This resulted in the bursting of the speculative bubble and resale movement and indicated a reversal of growth. It is undeniable that the stock market crash of 1929 played a role in accelerating the worsening of the world’s economic situation.

Media Lighting On The Event

- The stock market images show the fundamental role played by brokers, who acted as intermediaries between supply and demand for action. Their role was essential during the dark days of October 1929 since they were at the heart of the share resale movement, resulting in a cycle of lower prices. It should be noted that brokers did not always act in the sole interests of their clients but also received a percentage on each transaction. Historical pictures illustrate the bursting of the speculative bubble and the collapse of the courts, like a house of cards. Lastly, comparing images of the stock market with images of industrial sites illustrated the economic consequences of the stock market crash (i.e. closures and bankruptcies of many companies).